In today’s globalised financial ecosystem, anti-money laundering (AML) regulations are essential to prevent financial crimes and maintain market integrity. Navigating legal mandates, compliance standards, and advanced software solutions helps protect organisations from illicit activities. This guide explains what money laundering regulations are, why they are important, and how to achieve robust compliance through effective software, risk assessments, customer due diligence, and continuous employee training.

What Are Money Laundering Regulations and Why Are They Important?

Money laundering regulations are legal guidelines enforced worldwide to prevent the conversion of illegally obtained funds into legitimate revenue. They deter criminal enterprises by increasing the difficulty of transferring or investing contaminated money and require financial institutions to report suspicious transactions, implement strong customer onboarding processes, and conduct risk assessments. These laws support international cooperation, transparency in the financial sector, and safeguard the global system from the disruptions caused by organised crime.

Which Global AML Regulations Should Businesses Know?

Key regulations include the Financial Action Task Force (FATF) Guidelines, the European Union’s AML Directives, and country-specific laws such as the Bank Secrecy Act (BSA) in the United States. Influential bodies like the United Nations Office on Drugs and Crime (UNODC) and the Council of Europe set recommendations that help standardise requirements across jurisdictions.

How Do AML Laws Impact Financial Institutions and Businesses?

AML laws require institutions to build rigorous compliance frameworks and continuous monitoring systems. This legal impact forces significant investments in AML software, training, and internal controls. Non-compliance can result in fines, damage to reputation, and operational restrictions, emphasising the need for a strong culture of compliance.

What Are the Key Compliance Requirements Under AML Regulations?

Core requirements include robust customer due diligence (CDD) procedures, enhanced due diligence (EDD) for high-risk scenarios, precise record-keeping, and timely reporting via Suspicious Activity Reports (SARs). Routine risk assessments and up-to-date sanction lists ensure organisations can quickly adapt to evolving threats.

How Can Organisations Implement Effective AML Compliance Best Practices?

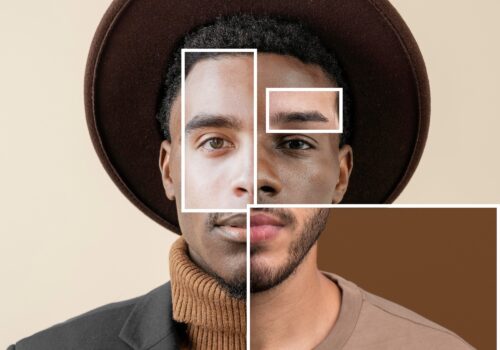

Image by vectorpocket

Effective AML practices involve creating, documenting, and enforcing policies that align with international standards. A risk-based approach—which integrates customer due diligence, continuous transaction monitoring, and regular employee training—ensures that compliance measures remain robust. Regular audits and independent assessments help quickly identify and address any deficiencies.

What Is Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD)?

CDD focuses on verifying a customer’s identity and understanding financial behaviour, while EDD applies to high-risk customers or transactions with extra scrutiny. Both processes require comprehensive data gathering, regular updates, and risk analysis to ensure appropriate measures are enforced.

How to Conduct AML Risk Assessments and KYC Procedures?

AML risk assessments identify vulnerabilities in processes, products, or customer segments. Coupled with Know Your Customer (KYC) procedures—which include reliable identity verification and background checks—organisations can detect suspicious patterns and maintain dynamic risk profiles for customers.

What Are the Best Practices for Transaction Monitoring and Reporting?

Organisations should continuously analyse transactions with automated systems designed to flag anomalies based on predefined rules and real-time data analytics. When anomalies are detected, filing a Suspicious Activity Report (SAR) promptly helps maintain regulatory compliance and enables rapid intervention.

How Are AML Audits and Assessments Conducted?

Regular AML audits involve systematic reviews of policies, procedures, and transaction records. Conducted by internal teams or external auditors, these audits identify weaknesses, ensure data accuracy, and support necessary improvements to maintain compliance and avoid penalties.

What Are the Features and Benefits of Anti-Money Laundering Software Solutions?

AML software solutions integrate tools for real-time transaction monitoring, automated risk assessments, and advanced analytics powered by artificial intelligence. Benefits include reducing human error, improving detection of suspicious activities, streamlining reporting, and enhancing overall regulatory compliance. Robust platforms are customizable and scalable to meet various industry needs.

How Does Transaction Monitoring Software Detect Suspicious Activity?

Such software continuously checks customer transactions against preset thresholds and patterns, using sophisticated algorithms and machine learning to flag deviations from normal behaviour. Timely alerts allow compliance teams to investigate issues before they escalate.

What Role Does AI Play in Enhancing AML Software Accuracy?

Artificial intelligence and machine learning models adapt to evolving trends and reduce false positives. By continuously learning from historical data, AI improves risk assessments and detection efficiency, significantly easing the compliance burden.

How Do CDD, EDD, and Sanctions Screening Software Work Together?

Integrated systems streamline the identification and verification process by cross-referencing customer profiles against global sanctions lists. This coordinated approach ensures thorough compliance and effective risk management.

What Are the Advantages of Scalable and Customizable AML Platforms?

These platforms can be tailored to an organisation’s specific size, industry, and regulatory needs. They seamlessly integrate with existing systems and adapt to evolving regulations, providing sustained operational efficiency as transaction volumes increase.

Why Is AML Training Essential and What Programs Are Available?

AML training equips employees with the skills needed to identify risks and adhere to complex regulatory frameworks. Effective training ensures that policies are correctly implemented, reducing compliance breaches and fostering a culture of accountability across the organisation.

What Are the Benefits of AML Certification and Employee Training?

Certification programs enhance staff knowledge of current regulations, emerging threats, and best practices, leading to fewer penalties and stronger internal audits. Regular training sessions also keep employees updated on any regulatory changes.

Which AML Training Programs Are Best for Banks and Fintech Companies?

Specialised training programs often provided by organisations such as ACAMS cover advanced topics like regulatory updates, machine learning in AML, and risk assessment techniques. These programs are tailored to the operational challenges unique to banks and fintech firms.

How Can Ongoing AML Education Improve Compliance Outcomes?

Continuous education keeps employees vigilant and informed about industry trends. This proactive approach minimises operational breaches and strengthens overall compliance, safeguarding the organisation from legal and financial risks.

What Is Suspicious Activity Reporting (SAR) and How Should It Be Handled?

Suspicious Activity Reporting (SAR) involves documenting and reporting activities that signal potential money laundering. Strict guidelines require detailed documentation, prompt filing, and thorough follow-up. Accurate SAR submissions are essential for empowering law enforcement to investigate suspicious activity effectively.

What Are the SAR Filing Requirements and Deadlines?

SAR reports must detail transaction information, customer history, and the reasons for suspicion. Regulations typically require filing within 30 days of detecting a suspicious activity, with strict adherence essential to avoid penalties.

How to Identify and Document Suspicious Activities Effectively?

Organisations should use advanced monitoring systems to analyse data and maintain comprehensive records. Effective documentation includes customer identification, transaction details, and clear explanations for classifying an activity as suspicious, all reviewed by a compliance officer prior to submission.

What Are the Best Practices for SAR Submission and Follow-Up?

Establishing an internal review process, leveraging automated reporting tools, and maintaining open communication with regulators are best practices for SAR submission. Follow-up procedures should include monitoring regulator feedback and periodic audits of the reporting system.

How Are Emerging Technologies Shaping the Future of Anti-Laundering?

Emerging technologies such as artificial intelligence, machine learning, and blockchain analytics are transforming AML processes by improving detection accuracy and automating routine tasks. These innovations enable institutions to analyse vast data sets in real time and more effectively spot suspicious patterns.

What Is the Impact of AI and Machine Learning on AML Processes?

By refining transaction risk assessments and identifying unusual behaviours, AI and machine learning significantly reduce false alarms. Their ability to learn from data continuously enhances both detection accuracy and operational efficiency.

How Is Blockchain Analytics Used to Combat Money Laundering?

Blockchain analytics helps trace cryptocurrency transactions across decentralised networks by analysing public ledger data. This transparency is crucial for detecting illicit crypto transactions, where conventional AML methods may fall short.

What Are the Challenges and Opportunities in Crypto AML Compliance?

Compliance in the crypto space involves addressing challenges like decentralisation and transaction anonymity while seizing opportunities to innovate real-time monitoring and analytics, often through dedicated crypto modules in modern AML software.

How Can Businesses Stay Updated on Regional and Global AML Regulatory Changes?

Staying current with regulatory changes is critical. Businesses should monitor updates from financial regulators, attend industry conferences, and subscribe to regulatory newsletters. This proactive approach helps align internal policies with new legal requirements and anticipate future risks.

What Are the Latest Updates From FinCEN, FATF, and EU AMLD?

Recent updates focus on enhanced technology-driven monitoring, stricter customer verification, and expanded reporting requirements for virtual assets. These measures aim to close regulatory gaps and foster international cooperation.

How to Adapt AML Programs to Meet Changing Legal Requirements?

Regular risk assessments, policy updates, and investments in scalable compliance tools are essential to adapt AML programs. Establishing dedicated compliance teams or collaborating with external experts can facilitate the interpretation and implementation of new mandates.

What Resources and Tools Support Continuous AML Compliance?

Resources such as regulatory databases, industry newsletters, webinars, and specialised software are vital. Advanced analytics platforms and mobile applications further support real-time monitoring and reporting, while industry associations offer valuable insights and updates.

| Regulation Body | Key Update Focus | Impact on Compliance | Next Steps |

|---|---|---|---|

| FinCEN | Enhanced SAR guidelines | Faster detection & reporting | Review internal SAR policies |

| FATF | Global AML best practices | Standardized international measures | Update risk assessment models |

| European AMLD | Broadened scope to crypto assets | Tighter control over virtual currencies | Integrate blockchain analytics tools |

Before implementing changes, review the latest guidelines directly from sources such as FinCEN, FATF, and relevant EU bodies.