Continuous KYC (cKYC): Why One-Time Verification Is No Longer Enough

Businesses can no longer afford to just conduct a one-time KYC (Know Your Customer)...

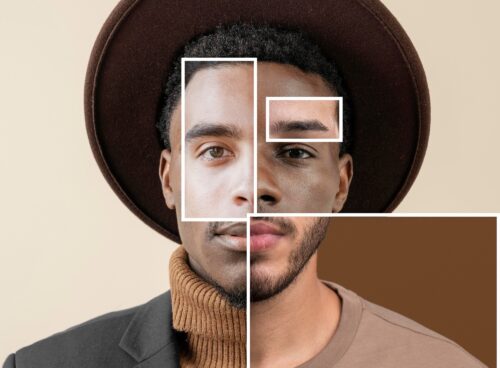

Deepfake Identity Fraud: How Financial Institutions Can Detect and Prevent AI-Powered Attacks

Fraudsters use AI-generated identities to trick verification systems, making biometric and liveness checks essential...

Smarter AML Compliance: Create Custom Screening Rules on Prembly

Take control of your AML compliance with Prembly’s Custom AML Rules. Define, manage, and...

Compliance Software Buyer’s Guide: Choosing the Best Regulatory Technology Solutions

This guide covers key features, vendor comparisons, and trends to help organizations choose the...

Digital Identity Verification for Stock Exchanges: Securing Capital Markets with KYC and Fraud Prevention

Digital identity verification is crucial for stock exchanges, providing a strong defense against fraud,...

Top Fintech Compliance Software and RegTech Solutions: Ensuring Effective AML and Risk Management

Explore key fintech compliance software and RegTech solutions focused on AML, KYC, and risk...

How to Securely Verify Customers on WordPress with Prembly Identity Checkout

Confirming the identity of your customers is essential for safeguarding your business and building...

Building Trust in Education: How Botosoft Uses Prembly for Secure WAEC Certificate Verification

For over 25 years, Botosoft Technologies has supported educational institutions with secure digital solutions...

How to Integrate Prembly’s SDK Into Your App or Platform

Integrating new features into your app or platform can sometimes feel overwhelming, especially when...

Politically Exposed Person (PEP): Definition, Risks, Screening, and Compliance

This guide breaks down what politically exposed persons (PEPs) are, why they matter, and...