Rental scams occur when tenants use false identities or forged documents to access properties, or when fraudsters pose as landlords or create fake listings to steal deposits or personal information. The outcomes of these fraudulent activities can be devastating, because they could lead to financial loss, data exposure, and broken trust between renters and owners.

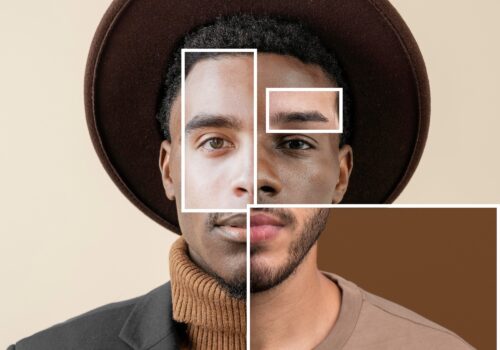

Digital identity verification (IDV) has become a vital protection against this growing threat. By employing automated checks like document authentication, biometric matching, and database cross-referencing, IDV makes sure that every renter or owner is who they claim to be. This process not only blocks fraudulent listings and applications but also safeguards landlords against false tenant identities and synthetic fraud schemes.

So, if you have pressing questions, such as, How to check if a rental listing is legitimate? What red flags to watch for in rental agreements? How can landlords verify tenant identities and avoid fraudulent applications? This article will clarify how landlords and property managers can spot rental scams and understand how verification reduces fraud. Renters will also find guidance on how to identify fake listings and protect their personal information.

The sections below cover the most common rental scams and how they operate, how renters can identify fake listings and fraudulent applications, how digital identity verification helps prevent rental fraud, and the benefits of online identity verification for property managers and owners.

What Are the Most Common Rental Scams?

The digital rental market is often the target of scams that exploit online listings, weak identity verification, and unsecured payment methods. Fraudsters use tactics such as synthetic identities, forged documents, ad hijacking, and phantom listings, which require little technical skill but still reach many targets. Being aware of the most common scam types and their red flags can help landlords and renters prevent fraud before any funds are exchanged.

Below are six of the most common rental scams, along with quick red flags to watch for:

- Phantom Listings: These scams involve offers for properties that either don’t exist or aren’t actually available for rent. The red flag is pressure to pay deposits or fees upfront without allowing property viewings.

- Synthetic Identity Fraud: This involves scammers creating completely false identities by combining real and fabricated data, making detection tricky without advanced verification. The red flag is perfect documents but a very limited or thin credit history.

- Ad Hijacking: Fraudsters steal images and details from legitimate rental listings and repost them with altered contact details to lure unsuspecting people. These listings lead renters to fake contacts who steal money or personal data. The red flag is that contact details differ from the official listing.

- Fake IDs and Altered Documents: Scammers may present falsified government-issued IDs, credit reports, or pay slips to look trustworthy during application processes. The purpose of this fake documentation is to evade standard identity checks. The red flag is mismatched names, dates of birth, or irregular fonts.

- First-party Fraud: This is when applicants intend to violate lease terms or skip payments, resulting in a loss for landlords. The red flag is reluctance to provide verifiable references.

- Falsified Income or Employment: Applicants submit fake employer verifications or falsified bank statements to prove income eligibility. The red flag is unverifiable employer details or generic pay stubs.

These scams highlight the need for multi-layered verification rather than single-point checks.

How Can Renters Identify Fake Rental Listings and Fraudulent Applications?

Renters can protect themselves from rental scams by carefully checking listing details before making any exchanges. Always insist on in-person or live video viewings and avoid requests for unusual payment methods like cryptocurrency or wire transfers. Verify the listing’s authenticity across multiple rental platforms and use reverse-image search engines to check if the images have been reused or stolen. Request valid credentials when interacting with the owner or agent, and never transfer money without a signed lease.

Documenting all correspondence and payment receipts can help if you need to report fraudulent activity to authorities. By following these renter-side precautions, you minimize the risk of falling victim to scams and enhance the identity verification process taken by landlords.

How Does Digital Identity Verification Prevent Rental Fraud?

Digital identity verification helps prevent rental fraud by ensuring fake applications or identity theft don’t go unnoticed. By combining document forensics, biometric checks, and database cross-referencing, property managers can verify identities quickly and accurately.

Here’s how it works: upon receiving an applicant’s ID, document forensics examines it to detect any changes or forgeries. Next, biometric verification uses liveness detection to confirm that the person matches the photo on the ID, preventing any chance of impersonation and deepfake-enabled fraud. Finally, database checks verify identity details against trusted data sources like credit, employment, or government records, flagging inconsistencies that suggest a fake or synthetic identity.

This multi-layered approach strengthens fraud prevention while keeping the rental process seamless. Automated verification decreases review time, enhances accuracy, and helps landlords onboard trusted tenants faster, without compromising compliance or trust.

Read more in our blog, “Prembly Background Check Feature.”

What Are the Benefits of Online Tenant Identity Verification for Landlords and Property Managers?

Online tenant identity verification enhances security, minimizes fraud-related losses, and simplifies the tenant screening process. By using automated ID verification and integrated fraud detection tools, landlords can easily confirm the legitimacy status of applicants and prevent costly scams. Screening applicants helps reduce the chances of payment defaults, deposit disputes, and costly evictions. These automated checks cut vacancies and manual work, which boosts operational efficiency for property managers.

Rental scams keep evolving, but solutions like Prembly’s multi-layered verification make it easier to verify identities, detect risks early, and prevent fraud throughout the rental process. By combining vigilance with digital identity verification, landlords and property managers can protect their investments and tenants’ trust.